Minimum annual wage for a couple with one child aged under 1, (adjusted to account for our actual mortgage and energy costs) according to the Joseph Rowntree Foundation’s Minimum Income Standard

Ever since I started this blog, I have been plagued by the thought that potential readers would be perfectly justified in dismissing my money-saving efforts as ridiculous. At the outset, I set myself a budget of £80 a week, after mortgage and household bills. To me, it sounded high; after all, unemployment benefit in the UK is currently set at £71 a week and that’s for everything. What’s more, I’ve been regularly relying on store-cupboard ingredients, falling back on store-card loyalty points, foreign currency or vouchers that I had in reserve. I’ve even gone over budget a couple of times. In short, I have felt like a bit of a fraud, albeit one that ’fesses up to her failings.

Today, however, the Centre for Research in Social Policy, funded by the Joseph Rowntree Foundation, published a report entitled A Minimum Income Standard for the UK. It’s a fascinating read. According to the report: “A minimum standard of living today includes, but is more than just food, clothes and shelter. It is about having what you need in order to have the opportunities and choices necessary to participate in society.” You can read the report and discover more about the Centre’s approach here.

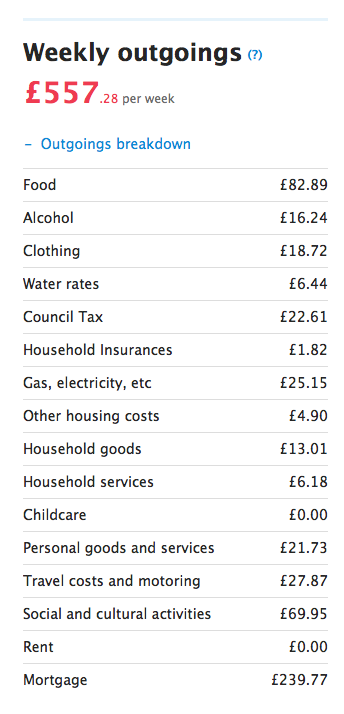

Weekly outgoings for a couple with no children, (adjusted to account for our actual mortgage and energy costs) according to the Joseph Rowntree Foundation’s Minimum Income Standard

What I found particularly heartening is that, using the website’s Minimum Income Calculator, I have discovered that my weekly budget falls well below the ‘minimum’: in fact, as a couple with no children, my husband and I would need £557.28 per week to conform to the standard of living defined in this report. To make a direct comparison (i.e. stripping out mortgage costs and household bills), my weekly budget should be £128.30. It appears I am £48.30 short of attaining this meagre standard each week. Now clearly, I actually have more money than this: I am choosing to save it rather than spend it and I am lucky to be in a position to choose at all.

However, it’s not as if we’re saving to buy a pair of designer shoes. We’re saving for the next stage of our lives and that has been bought into sharp perspective by a further turn on the Minimum Income Calculator.

Reader, I would like to have a baby. There I’ve said it. I’m not saying that I want to have a baby right this second, but I would like one in the next few years. I am 30, I am married and I own a tiny proportion of my own home. To the casual observer, there is no reason on this earth that I shouldn’t have one.

My employment contract entitles me to statutory maternity pay (SMP). Nothing more, nothing less. For those not familiar with SMP: for the first six weeks, you get 90% of your average gross weekly earnings. For the remaining 33 weeks, you get £135.45 per week.

Weekly outgoings for a couple with one child aged under 1, (adjusted to account for our actual mortgage and energy costs) according to the Joseph Rowntree Foundation’s Minimum Income Standard

Back to the minimum income calculator. If my husband and I had a child aged 0-1, we would need £619.24 a week, assuming we continued to live in our five-room flat (kitchen-diner, sitting room, 2 bedrooms, bathroom), to achieve this basic standard. My share of that is £309.62. It doesn’t take a genius to work out that my maternity pay would leave me £174.17 short every week, or £5,747.61 over those 33 weeks.

And it doesn’t stop there; it’s not as if I can just go back to my job after nine months and leave the child at home. When/if I go back to work, I will then have to pay for childcare. As you all know, my disposable income is currently £820 per month (and it’s not looking likely that that will change for the better any time soon). According to the calculator, I would need disposable income of £696.17 per month, before childcare to maintain a minimum standard of living. That would leave me £123.83 to spend on child care per month. My official working hours are 9am to 5.30pm. Let’s assume that I never work late (I wish), I make that 40 hours per week. According to the daycare trust’s 2010 report, the average cost for 25-hours of care for children aged under 2 in London was £109. For my 40-hour week, not including travel time, that is £174.40. Errrrrr…..

In other words, with my ‘spare’ £123.83, I could afford just over 28 hours of childcare. Per month. At 2010’s prices. Let’s say the husband chips in: we can afford 56 hours of childcare per month. Woop di woop di woo.

This morning, as per my daily routine, I watched BBC news as I put on my make-up. Today’s discussion was the age at which women are ‘choosing’ to have children. It was the usual discussion: we’re having children later, blah di blah di blah. Women who wait to have children are risking infertility, miscarriages and complications. So far, so predictable—although this was the BBC, so it was less scare-mongering than usual. One aspect that was missing, however, from the segment I watched at least—I had to leave for work half-way through— was the issue of money. Has it not occurred to anyone that even if we’ve miraculously found someone to have children with during our child-bearing years (NOT a given, and something I am thankful for every single day), we can’t actually afford to have them?